California Overtime Law for 2022

California enforces various strict labor laws intended to preserve workers’ rights and prevent workers from being forced to work too many hours in a day or too many hours in a week. The California overtime laws for 2022 intend to make employers’ overtime obligations clearer, ensuring employees are paid appropriately for their time at work every day and every week.

Overtime laws ensure employees are appropriately compensated when they go above and beyond the typical demands of a normal workday or when they work more than the standard 40 hours of full-time work per week. However, there are some exceptions to the California overtime law, and in 2022 new laws took effect that all employees and employers in California must understand.

How Does Overtime Work in California?

California’s standard definition of “overtime” is any time spent working past eight hours in a single day or more than 40 hours in a workweek. Once an employee reaches overtime, the standard pay rate is 1.5 times their usual hourly rate. For example, if an employee typically earns $20 per hour at their job, their overtime rate would be $30 per hour. If an employee who qualifies for overtime works 10 hours in a single day, they would receive $20 per hour for the first eight hours and then $30 per hour for the remaining two hours.

Overtime pay increases to “double time” rates once an employee works more than 12 hours in a day. Following the previous example, the employee earning $20 per hour as their usual wage would earn $30 per hour for four hours following their usual eight-hour shift. Once they have worked 12 hours, they must be paid $40 per hour for every hour worked past 12 hours. For example, in a 14-hour day, the employee would receive their usual $20 rate for the first eight hours, then four hours of $30 overtime pay, followed by two hours of double-time pay at $40 per hour. The double-time rule also applies if an employee works for more than eight hours on a Sunday after a seven-day workweek. Their first eight hours on Sunday would be paid at their overtime rate, followed by double-time pay for all hours past the first eight.

What Happens If an Employer Doesn’t Pay Overtime Correctly?

Unpaid overtime can lead to stressful legal disputes between employees and employers. While some employers may make honest calculation errors or experience issues with their time reporting systems, these problems are generally easy to correct. However, some employers go so far as to deliberately deny their employees overtime pay using various tactics. Some of the actions taken by employers to deny employees overtime in California have included:

- Mandatory overtime policies. Some companies have attempted to compel employees to work more than the standard eight-hour workday without paying overtime rates. The recent California overtime laws for 2022 seek to prevent this by defining employers’ overtime rules more clearly.

- Overtime pay waivers. Previously, employers have attempted to convince employees to waive their right to overtime pay. However, employees cannot waive their right to overtime pay in California. Employment contracts also may not stipulate that an employee agrees to waive their overtime rights or that overtime will be paid at any rate lower than the standard 1.5 rate or double time right when applicable.

- Miscalculated travel time. While California law does not consider commute time as compensable hours worked, travel time does count toward overtime calculations. Therefore, if you are required to travel for work, the hours spent traveling must be accurately calculated by your employer if you qualify for overtime or double-time pay.

- Misclassification of employees. Many salaried employees in California are exempt from overtime rules. As a result, some employers may attempt to misclassify employees to avoid paying them overtime.

- Timesheet manipulation. California’s overtime laws require employers to accurately record employee hours worked per day and per week. As a result, employers may attempt to count hours for one day as hours worked for a different day or otherwise manipulate timesheets to avoid paying overtime.

If you believe your employer has unfairly and illegally denied you overtime or double-time pay required by California law, it’s vital to consult an experienced employment attorney as soon as possible. Your attorney can help you file a wage and hour dispute and recover the pay you legally deserve. In addition, in some cases, employees denied overtime might be entitled to additional damages.

FAQs

Q: What Is the New Overtime Law in California?

A: The new California overtime law for 2022 clearly defines employer responsibility for overtime and double-time pay. The law also establishes new guidelines for agricultural workers. Employers with 26 or more agricultural employees must pay overtime after eight hours in a workday or 40 hours in a workweek. Employers with 25 or fewer agricultural workers must pay overtime after 9.5 hours in a workday or after 55 hours in a workweek.

Q: Does California Require Overtime After Eight Hours in a Day or After 40 Hours in a Week?

A: California overtime laws require both, but an employee’s schedule typically determines which form of overtime applies to them. For example, if an employee’s schedule includes four 10-hour shifts per workweek, this would be an alternative work schedule that does not require overtime pay unless they exceed 40 hours in a workweek, even though they work more than eight hours per day. On the other hand, if the employee’s standard workweek includes five eight-hour shifts, they would be paid overtime for any hours worked over eight hours in a workday.

Q: What Is the Current Minimum Wage in California in 2022?

A: Employers with 25 or fewer employees must pay a minimum wage of $14 per hour, and employers with 26 or more employees must pay a minimum wage of $15 per hour. These employers’ “time and a half” overtime rates would be $21 per hour and $22.50 per hour, respectively. The double-time rates would be $28 per hour and $30 per hour, respectively.

Q: Who Is Exempt From Overtime in California?

A: Most salaried employees, “professional” employees, outside sales professionals, and independent contractors are typically exempt from overtime pay. However, employers who enter into employment contracts with these employees must clearly explain their pay and compensation policies in these agreements. If you are unsure whether you are exempt from overtime laws, speak with an employment attorney about your employment contract.

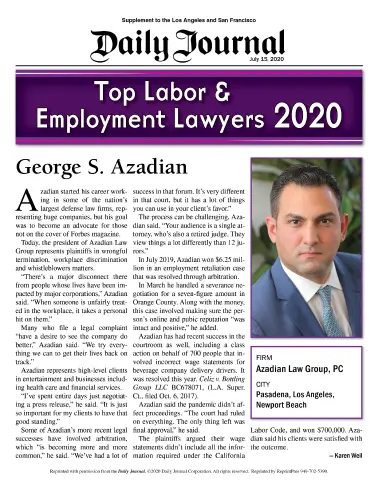

The Azadian Law Group, PC, offers comprehensive legal counsel to employees facing overtime disputes and other wage and hour claims with their employers. If you believe you have been unfairly denied overtime pay, contact us today to schedule a consultation and learn how we can assist you.

Related Blog Posts

While you’re deciding on an attorney for your wrongful termination or employment discrimination lawsuit, here are 5 questions you should...

Read MoreMost employment in California functions under the terms of at-will employment law. The at-will employment law aims to ensure employees...

Read MoreThe Equal Employment Opportunity Commission (EEOC) of the United States is a component of the US Department of Labor. The...

Read MoreTypes of Cases Handle By Employment Lawyers in Los Angeles, CA

The following presents an overview of the broad range of employment law cases that our employment attorneys are experienced at overseeing and favorably resolving.

Wrongful Termination

Wrongful Termination Lawyers in Los Angeles, CA Attorneys at Azadian Law Group who have filed wrongful termination lawsuits acknowledge that unfair termination can significantly impact an employee’s life. It can…

Age Discrimination

Age Discrimination Lawyers in Los Angeles, CA Azadian Law Group, PC regularly represents clients throughout Los Angeles, CA, who are the victims of age discrimination in the workplace. At Azadian…

Pregnancy Discrimination

Pregnancy Discrimination Lawyer in Los Angeles, CA At Azadian Law Group, PC, our pregnancy discrimination lawyer in Los Angeles, regularly represents clients who are the victims of pregnancy discrimination in…

Sexual Harassment

Sexual Harassment Attorney in Los Angeles, CA The Los Angeles Sexual Harassment Lawyers at Azadian Law Group, PC, know that in today’s modern era, some people often make the mistake of…

Racial Discrimination

Racial Discrimination Lawyers in Los Angeles, CA Azadian Law Group, PC regularly represents clients throughout Los Angeles who are the victims of racial discrimination at work. The Los Angeles Race…

Disability Discrimination

Disability Discrimination Attorneys in Los Angeles, CA There is a misconception that disabled people do not want to work or that disabled individuals simply cannot or will not be as…

Praise from Our Clients

Who We Represent

At Azadian Law Group, we are dedicated to upholding the rights and interests of employees in the workplace. Our expertise in employment law positions us as staunch advocates for those facing unjust treatment in their professional environments.

Whether combating workplace discrimination, addressing unfair termination, or negotiating equitable compensation, our team is committed to ensuring that every employee we represent is treated fairly and respectfully under the law.

Step 1

Explore our comprehensive range of legal services to find the specialized support you need.

Step 2

Arrange a free initial meeting with our experts to discuss your legal situation.

Step 3

Receive a custom strategy specially created for your case by our legal experts.

Call Us Now 213-229-9031

Tell Us Your Story

Speak out for justice. Your story can be the start of a new chapter of workplace fairness.