Los Angeles Unfair Debt Collection Lawyer

Unfair Debt Collection Lawyer in Los Angeles, CA

Over $45 Million Collected For Employees

The FDCPA was passed by Congress to combat the unfair debt collection practices used by many creditors and debt collectors. Although debt collection is perfectly legal, the FDCPA has established rules for the collection of consumer debts and provides protections to debtors by enabling them to challenge creditors and determine the validity and accuracy of asserted debts.

Despite these debt collection laws, many debt collectors reportedly engage in illegal conduct in an attempt to collect on debts.

Under the FDCPA, a debt collector is anyone who regularly collects debts that are owed to others, including debt collection agencies, companies that purchase and attempt to collect on delinquent debts, and debt collection lawyers who help companies who help creditors, debt buyers, or even debt collection firms. Many states, including California, have enacted their own state versions of the FDCPA that apply to and regulate not only debt collectors but also creditors, including banks, credit card companies, etc.

If a debt collector is found to have violated the FDCPA, the debtor is entitled to receive $1,000 in statutory damages, plus any actual damages that they have suffered.

Abusive Debt Collection Practices Include:

- Harassment: With few exceptions, debt collectors are prohibited from contacting consumers who have notified them in writing to cease communication. Debt collectors are also generally prohibited from using threats and abusive language.

- Hours for phone contact: contacting consumers by telephone outside of the hours of 8:00 a.m. to 9:00 p.m. local time.

- Failure to cease communication upon request: communicating with consumers in any way (other than litigation) after receiving written notice that said consumer wishes no further communication or refuses to pay the alleged debt, with certain exceptions, including advising that collection efforts are being terminated or that the collector intends to file a lawsuit or pursue other remedies where permitted.

- Causing a telephone to ring or engaging any person in telephone conversation repeatedly or continuously: with intent to annoy, abuse, or harass any person at the called number.

- Communicating with consumers at their place of employment after having been advised that this is unacceptable or prohibited by the employer.

- Contacting consumer known to be represented by an attorney.

- Communicating with consumer after request for validation has been made: communicating with the consumer or the pursuing collection efforts by the debt collector after receipt of a consumer’s written request for verification of a debt made within the 30 day validation period (or for the name and address of the original creditor on a debt) and before the debt collector mails the consumer the requested verification or original creditor’s name and address.

- Misrepresentation or deceit: misrepresenting the debt or using deception to collect the debt, including a debt collector’s misrepresentation that he or she is an attorney or law enforcement officer.

- Publishing the consumer’s name or address on a “bad debt” list.

- Seeking unjustified amounts, which would include demanding any amounts not permitted under an applicable contract or as provided under applicable law.

- Threatening arrest or legal action that is either not permitted or not actually contemplated.

- Abusive or profane language used in the course of communication related to the debt.

- Communication with third parties: revealing or discussing the nature of debts with third parties (other than the consumer’s spouse or attorney).

- Contact by embarrassing media, such as communicating with a consumer regarding a debt by post card, or using any language or symbol, other than the debt collector’s address, on any envelope when communicating with a consumer by use of mail or by telegram, except that a debt collector may use his business name if such name does not indicate that he is in the debt collection business.

- Reporting false information on a consumer’s credit report or threatening to do so in the process of collection.

If you believe a debt collector has violated your rights, please contact us for a free case evaluation.

Praise from Our Clients

Who We Represent

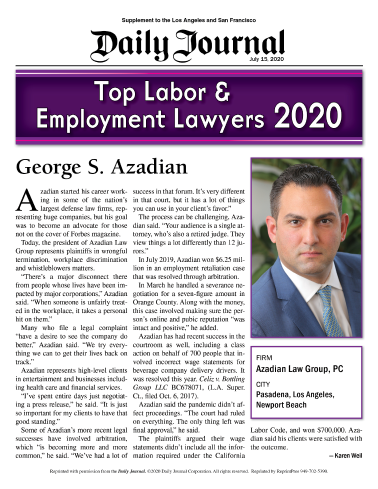

At Azadian Law Group, we are dedicated to upholding the rights and interests of employees in the workplace. Our expertise in employment law positions us as staunch advocates for those facing unjust treatment in their professional environments.

Whether combating workplace discrimination, addressing unfair termination, or negotiating equitable compensation, our team is committed to ensuring that every employee we represent is treated fairly and respectfully under the law.

Step 1

Explore our comprehensive range of legal services to find the specialized support you need.

Step 2

Arrange a free initial meeting with our experts to discuss your legal situation.

Step 3

Receive a custom strategy specially created for your case by our legal experts.

Call Us Now 213-229-9031

Tell Us Your Story

Speak out for justice. Your story can be the start of a new chapter of workplace fairness.