California Mileage Reimbursement Law for 2022

California employment laws include various regulations regarding pay, benefits, and expense compensation for employees. Employers must abide by these terms and pay their employees appropriately. When it comes to business-related expenses, employers are typically responsible for compensating their employees for any expenses they incur while performing their job duties. For example, if you must use your own vehicle for work, your employer likely owes you compensation for the mileage you put on your vehicle as you perform your job duties.

It’s important to note that California law does not require employers to compensate employees for mileage incurred during their commutes to and from work. Therefore, if you must drive to and from your workplace every day but do not need to drive to perform your job duties, your employer does not owe you mileage reimbursement. However, if you travel for work, your employer must compensate your mileage correctly.

How Much Should I Receive for Mileage?

Employees should be fully compensated for any expenses they incur to help run their employer’s business. For example, if you are sent to pick up supplies for your workplace from a local store, your employer is responsible for repaying the cost of the supplies and the mileage you incurred to perform the pick-up. Additionally, if you must use your own vehicle to travel during your workdays, your employer is also responsible for reimbursing your mileage.

As of January 2021, California employers are responsible for paying 56 cents per mile as mileage reimbursement. This reimbursement aims to compensate employees for the cost of fuel and the gradual wear and tear on their vehicles. Some employers, particularly those that routinely require employees to drive to perform their job duties, may offer higher compensation for mileage. If you have an employment contract with your employer that stipulates a mileage reimbursement policy, the employer must abide by the terms of this policy to the letter.

What Happens If My Employer Refuses to Compensate Mileage?

If you believe you have the right to expect mileage reimbursement from your employer, but they have failed or refused to compensate your mileage appropriately, it’s vital to consult an experienced attorney as soon as possible to determine your best options for legal recourse. Many wage and hour disputes in California pertain to minimum wage and overtime violations, as well as benefits-related issues and disputes over expenses.

If your employer owes you reimbursement for the mileage you incurred while performing work-related duties, you have the right to seek compensation for this unpaid expense. Depending on how long they have failed to pay you for your mileage appropriately, they may owe you hundreds or even thousands of dollars in mileage reimbursement. If your employer has refused to remit payment for your mileage, you should speak with an employment attorney as soon as possible.

It’s important to note that if you intend to seek compensation for your mileage, you must be prepared to prove that you incurred your claimed miles while performing work-related duties. This is why it is imperative to keep accurate records of your mileage for work. Most vehicles have mile counters that can be reset manually. In addition, using your trip monitor and logging your miles in some verifiable record can be invaluable in a later mileage dispute. For example, your employer may dispute your claim by alleging that your vehicle’s claimed mileage was accrued through regular personal use. However, if you have records proving when you drove for work and the mileage accrued for each trip, this will disprove their allegation and support your position in the case.

FAQs

Q: What Is California’s Law for Mileage Reimbursement?

A: California state law and US federal law require employers to reimburse employees for any work-related expenses they incur. Employees are expected to keep receipts and records so they can verify their expenses. When it comes to mileage, California law requires employers to pay at least 56 cents per mile driven by an employee who uses their own vehicle for work-related duties. Make sure you track miles driven for work very carefully with verifiable proof.

Q: What Is the GSA Mileage Rate for 2022?

A: The General Services Administration (GSA) is responsible for enforcing employment regulations for federal employees. If you work for the federal government in California, you will likely be issued a government vehicle to use for work. If you are not, and you must use your own vehicle, the GSA requires your employer to reimburse you 58.5 cents per mile driven in your own vehicle.

Q: What Is the IRS Rule for Mileage Reimbursement?

A: Mileage reimbursement is generally non-taxable if it does not exceed the IRS’s mileage reimbursement rule, which is 56 cents per mile. California mileage reimbursement law aligns with this rule, so as long as your employer pays the standard 56 cents per mile, your mileage reimbursement is not taxable. However, if your employer pays more per mile, you may face some taxation on your mileage reimbursements.

Q: Can I Sue My Employer for Unpaid Mileage?

A: California employers are legally responsible for repaying employees for all work-related expenses. When they fail to meet this obligation, affected employees have the right to file claims for unpaid expenses, which sometimes escalate into civil lawsuits. However, most employers are willing to negotiate settlements and private resolutions to mileage disputes rather than face public lawsuits.

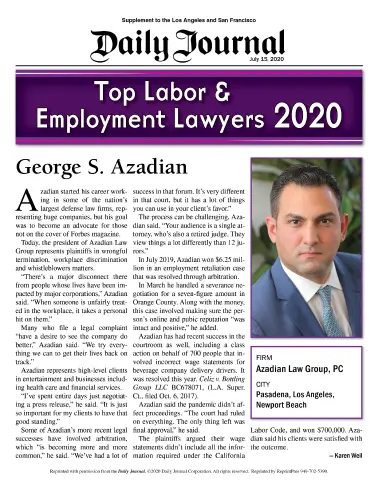

The employment laws of California are complex, strict, and often challenging to interpret. If you are unsure whether your employer has fulfilled their legal obligations pertaining to mileage and your other work-related expenses, it’s essential to speak with an experienced California employment attorney as soon as possible. The sooner you secure legal counsel, the easier it will be to hold your employer accountable for the mileage compensation they owe. The Azadian Law Group, PC, has years of experience representing California clients in a wide range of employment cases. We can leverage this experience for your benefit in a mileage dispute. Contact us today to schedule your consultation and learn more about the legal services we offer.

Related Blog Posts

The federal government has once again postponed enforcement of its TikTok divestiture mandate. Originally scheduled to force ByteDance to sell...

Read More🚨 The Return of Schedule F: Loyalty Over Merit? The federal government is undergoing one of its biggest shake-ups in...

Read MoreAccess to restroom breaks is a fundamental workplace right, but what happens when an employer allegedly punishes an employee for...

Read MoreTypes of Cases Handle By Employment Lawyers in Los Angeles, CA

The following presents an overview of the broad range of employment law cases that our employment attorneys are experienced at overseeing and favorably resolving.

Wrongful Termination

Wrongful Termination Lawyers in Los Angeles, CA Attorneys at Azadian Law Group who have filed wrongful termination lawsuits acknowledge that unfair termination can significantly impact an employee’s life. It can…

Age Discrimination

Age Discrimination Lawyers in Los Angeles, CA Azadian Law Group, PC regularly represents clients throughout Los Angeles, CA, who are the victims of age discrimination in the workplace. At Azadian…

Pregnancy Discrimination

Pregnancy Discrimination Lawyer in Los Angeles, CA At Azadian Law Group, PC, our pregnancy discrimination lawyer in Los Angeles, regularly represents clients who are the victims of pregnancy discrimination in…

Sexual Harassment

Sexual Harassment Attorney in Los Angeles, CA The Los Angeles Sexual Harassment Lawyers at Azadian Law Group, PC, know that in today’s modern era, some people often make the mistake of…

Racial Discrimination

Racial Discrimination Lawyers in Los Angeles, CA Azadian Law Group, PC regularly represents clients throughout Los Angeles who are the victims of racial discrimination at work. The Los Angeles Race…

Disability Discrimination

Disability Discrimination Attorneys in Los Angeles, CA There is a misconception that disabled people do not want to work or that disabled individuals simply cannot or will not be as…

Praise from Our Clients

Who We Represent

At Azadian Law Group, we are dedicated to upholding the rights and interests of employees in the workplace. Our expertise in employment law positions us as staunch advocates for those facing unjust treatment in their professional environments.

Whether combating workplace discrimination, addressing unfair termination, or negotiating equitable compensation, our team is committed to ensuring that every employee we represent is treated fairly and respectfully under the law.

Step 1

Explore our comprehensive range of legal services to find the specialized support you need.

Step 2

Arrange a free initial meeting with our experts to discuss your legal situation.

Step 3

Receive a custom strategy specially created for your case by our legal experts.

Call Us Now 213-229-9031

Tell Us Your Story

Speak out for justice. Your story can be the start of a new chapter of workplace fairness.